Which descriptor relates to the asset-based approach for valuing corporations? This question delves into the heart of corporate valuation, where the asset-based approach stands out as a prominent method for determining a company’s worth. This approach, characterized by its focus on tangible and intangible assets, offers a unique perspective on a company’s financial health and future prospects.

In this comprehensive guide, we will explore the intricacies of the asset-based approach, examining its key characteristics, steps involved, limitations, and practical applications. Through real-world case studies and expert insights, we aim to provide a thorough understanding of this essential valuation technique.

Overview of the Asset-Based Approach: Which Descriptor Relates To The Asset-based Approach For Valuing Corporations

The asset-based approach (ABA) is a corporate valuation method that determines a company’s worth based on the value of its assets. This approach focuses on the intrinsic value of the company’s tangible and intangible assets, considering their fair market value and potential liquidation value.

ABA is commonly used in industries with significant tangible assets, such as manufacturing, mining, and real estate. It is also employed when a company is facing financial distress or is considering liquidation.

Compared to other valuation methods, ABA has the advantage of being straightforward and relatively easy to apply. It provides a clear assessment of the company’s underlying assets, making it less susceptible to subjective factors.

Key Characteristics of the Asset-Based Approach

ABA is distinguished by its emphasis on the value of a company’s assets, both tangible and intangible. Tangible assets include physical assets such as property, equipment, and inventory, while intangible assets encompass intellectual property, brand recognition, and customer relationships.

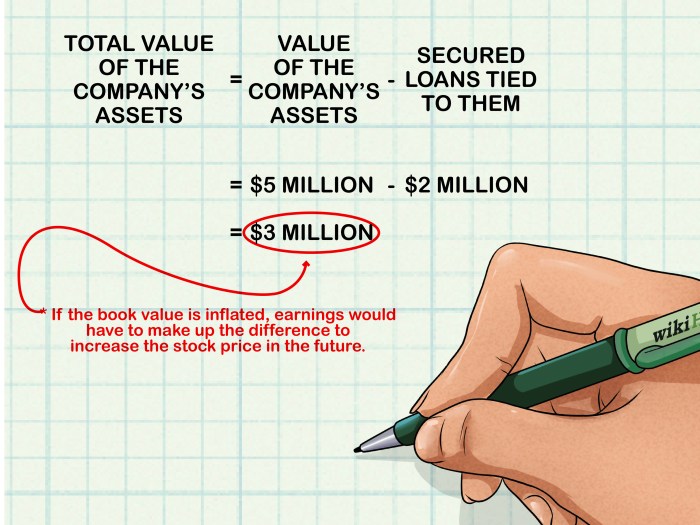

In ABA, the liquidation value of assets is considered, which represents the amount that could be realized if the company were to sell its assets on the open market. This value provides a lower bound for the company’s worth.

On the other hand, the going-concern value reflects the value of the company as a functioning entity. It considers the potential earnings and cash flows that the company can generate in the future.

Steps Involved in the Asset-Based Approach

- Identify and Classify Assets:Identify all of the company’s assets, both tangible and intangible, and classify them into appropriate categories.

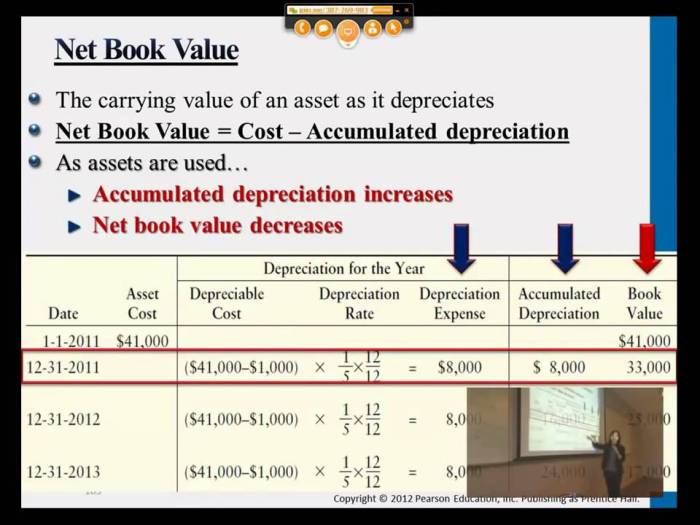

- Determine Fair Market Value:Use various valuation techniques, such as comparable sales, cost approach, and income approach, to determine the fair market value of each asset.

- Calculate Liquidation Value:Sum up the fair market values of all assets to determine the company’s liquidation value.

- Calculate Going-Concern Value:Use financial projections and industry benchmarks to estimate the company’s future earnings and cash flows. Capitalize these cash flows at an appropriate discount rate to determine the going-concern value.

- Reconcile Liquidation and Going-Concern Values:Compare the liquidation value and going-concern value to determine the final valuation. The final value should reflect the company’s potential as a functioning entity while considering its underlying asset value.

Limitations of the Asset-Based Approach

- May Overvalue or Undervalue Assets:The fair market value of assets can be subjective and may not always reflect their true value.

- Ignores Future Earnings Potential:ABA focuses on the value of assets at a specific point in time and may not fully capture the company’s growth potential.

- Less Relevant in Intangible-Heavy Companies:ABA may not be suitable for companies with a high proportion of intangible assets, as these assets may not be easily valued.

Case Studies and Applications, Which descriptor relates to the asset-based approach for valuing corporations

Case Study 1: Manufacturing Company:A manufacturing company used ABA to determine its liquidation value in preparation for a potential sale. The company’s tangible assets, including machinery and inventory, were valued at $10 million, while its intangible assets were estimated to be worth $5 million.

The company’s liquidation value was determined to be $15 million.

Case Study 2: Real Estate Company:A real estate company used ABA to value its portfolio of properties. The company’s properties were valued using comparable sales and cost approach techniques, resulting in a total value of $20 million. The company’s going-concern value was estimated at $25 million, considering its potential rental income and appreciation.

FAQ Explained

What is the fundamental principle of the asset-based approach?

The asset-based approach assumes that the value of a corporation is primarily determined by the value of its assets.

What are the key characteristics of the asset-based approach?

The asset-based approach focuses on tangible and intangible assets, considers both liquidation value and going-concern value, and involves a step-by-step process of identifying, classifying, and valuing assets.

What are the limitations of the asset-based approach?

The asset-based approach may not be suitable in situations where intangible assets are significant or when future earnings potential is a major factor in determining value.